The City of Lakewood is moving to refund over $42 million to telecommunications companies after the Colorado Supreme Court ruled its Business & Occupation (B&O) tax expansions unconstitutional. In a presentation to the City Council on January 26, 2026, city officials outlined a “Next Steps” plan to settle the massive debt and adjust the municipal budget.

The ruling centers on amendments made to the city’s B&O tax in 1996 and 2015. While the city argued these changes were necessary to comply with federal and state regulations regarding “competitive neutrality,” the Court found that expanding the tax to include cellular and new telecommunications providers without voter approval violated the **Taxpayer’s Bill of Rights (TABOR)**.

Originally established in 1969, the tax was intended for traditional utility companies providing landline exchange services. By expanding it to modern cellular services, the court determined Lakewood had essentially created a “new tax” that required a ballot measure.

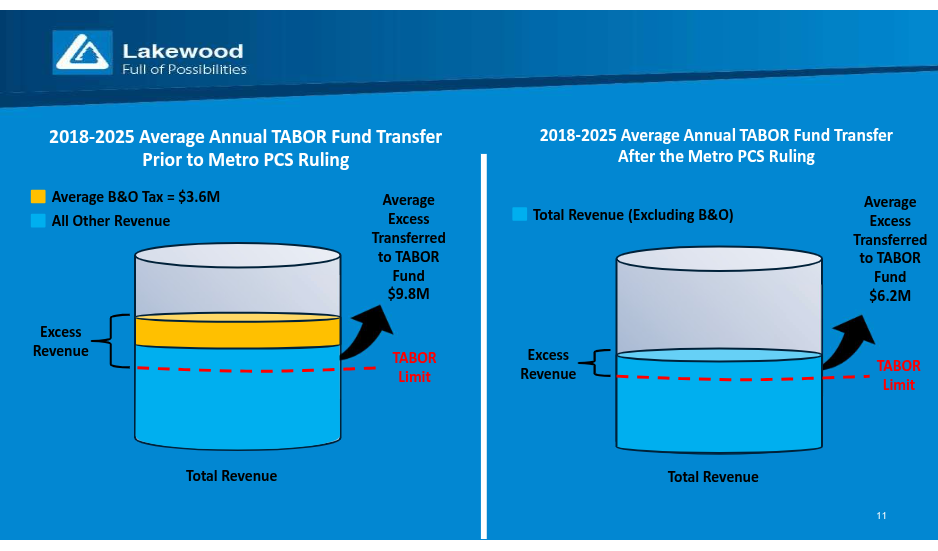

The impact on Lakewood’s finances is significant:

- Total Refund Liability: Up to $42.15 million owed to approximately 177 providers.

- Revenue Loss: The city will permanently stop collecting the B&O tax, which averaged $3.6 million in annual revenue.

- Funding Sources: Lakewood plans to pull from the General Fund and use existing TABOR reserves to cover the payout.

Finance officials warned that while the city remains solvent, the loss of these funds will likely delay or reduce the scope of planned capital projects, including infrastructure and park improvements.

The city has launched an interactive process to verify company data and issue refunds. For residents who may have seen these taxes passed through to their cell phone bills, the city is directing inquiries to the individual service providers.

“Finance is evaluating the impact on the current budget… [and] working with departments to determine budget changes to adjust for the impact,” the presentation noted, signaling a period of austerity for future city projects.

The City Council is expected to finalize a resolution and an ordinance to stop tax collection formally and authorize the necessary budget supplemental to facilitate the refunds.

Source: Slide Show Presentation to City Council