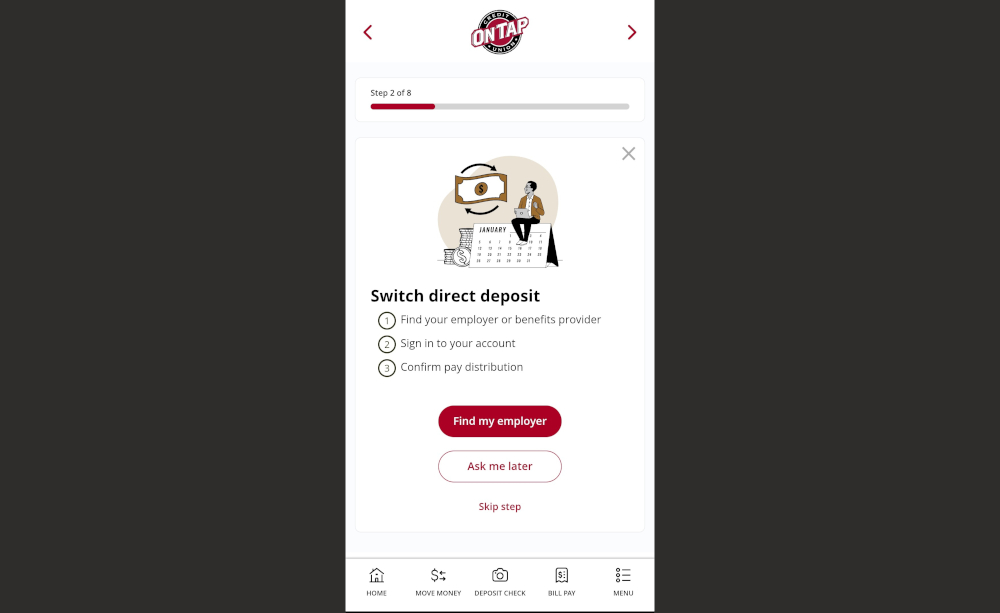

On Tap Credit Union has launched a new digital tool designed to simplify how members activate accounts and manage their financials remotely. The upgraded platform allows members to easily update their direct deposits and recurring payments directly through online banking.

This development is part of On Tap Credit Union’s commitment to enhancing member service and streamlining the account onboarding process. The tool helps members transition direct deposits and subscriptions such as Amazon and Netflix while maintaining the credit union’s established security standards.

Janelle Herrera, VP of Marketing and Business Development, explained the innovation, stating, “For years, banks and credit unions have promised an easy way to switch your direct deposit and update your card info, but too often, it was just a checklist with no real support. We’re proud to change that.”

The enhanced onboarding platform supports new members in funding their accounts and setting up their direct deposits. It will also facilitate the transition of existing members to more comprehensive banking services.

On Tap Credit Union, originally founded as Coors Credit Union in 1954, focuses on serving individuals in Jefferson, Denver, Boulder, and Larimer counties. The credit union currently manages $400 million in assets and has a member base of 20,000. Its offerings include a range of financial solutions such as loans, insurance, and investment accounts, all accessible through its online platform.

Source: Press Release